Displaying 81 - 90 of 156

28 August 2023, Hiroshima, Japan – Lê Nguyen An Khanh is a young diplomat from Viet Nam, working at the Department of International Organisations at the Ministry of Foreign Affairs. She believes that diplomats like her have the responsibility to advocate for nuclear disarmament. But it’s not always easy to keep abreast of the intricacies of field. “We are constantly having [to] research all the issues, of which nuclear disarmament and non-proliferation is a huge part”, she says.

18 August 2023, Hiroshima, Japan – Talita Tuipolutu, a communications coordinator for the Tonga Australia Support Platform, developed a stronger passion for disaster risk reduction after experiencing the devastation caused by cyclones, earthquake and tsunami in Tonga. She joined the 2022 UNITAR Hiroshima Women’s Leadership in Tsunami-based Disaster Risk Reduction Training Programme so she could help her community better prepare for future disasters.

16 August 2023, Hiroshima, Japan - Tariq Rauf, former Head of Nuclear Verification and Security Policy Coordination at the International Atomic Energy Agency, trains diplomats from Asian countries to negotiate effectively for nuclear disarmament and non-proliferation. Since 2015, he has been a key resource person for UNITAR Hiroshima’s Nuclear Disarmament and Non-Proliferation Training Programme.

14 August, Hiroshima, Japan – Since 2016, Yuriy Kryvonos has been training diplomats through UNITAR’s Nuclear Disarmament and Non-Proliferation (NDNP) Training Programme in Hiroshima. The former Director of the Regional Centre for Peace and Disarmament Affairs in Asia and the Pacific (United Nations Office for Disarmament Affairs) with over 20 years of experience reflect on the programme and his relationship with UNITAR Hiroshima.

29 May 2023, Hiroshima, Japan - Amid growing global worries of nuclear threats, nearly 20 diplomats and government officials from Asian countries gathered in Hiroshima from 13 to 18 February 2023, for the UNITAR nuclear disarmament and non-proliferation (NDNP) training programme. Among them was Mohd Ishrin Bin Mohd Ishak, a Malaysian diplomat. He joined the programme to update his understanding of the United Nations disarmament and non-proliferation bodies and the risks associated with nuclear weapons.

29 May 2023, Hiroshima, Japan - Nineteen-year-old Céline Arslane has a dream: to become a human rights activist and provide psychological support to refugees and war survivors. She wants to help people as others helped her.

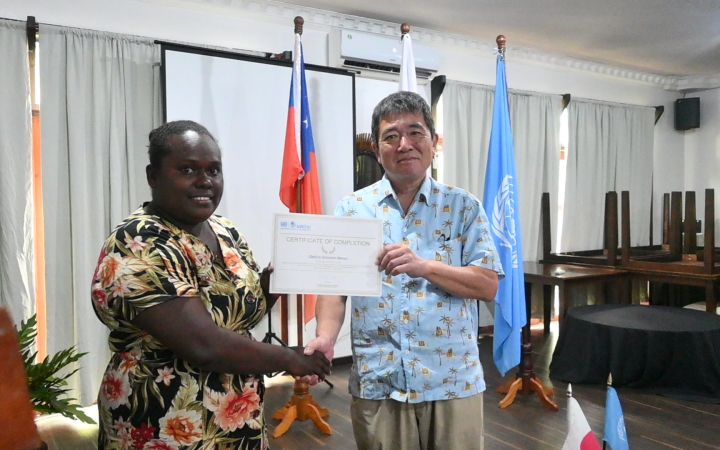

Deltina Solomon is a deputy project manager for two United Nations Development Programme (UNDP) disaster management projects in the Solomon Islands. She joined the 2022 UNITAR Hiroshima Women’s Leadership in Tsunami-based Disaster Risk Reduction Training Programme to enhance her work as a front-line officer in disaster risk reduction.

25 May 2023, Hiroshima, Japan - Baghdad is home to a growing community of entrepreneurs looking to make a mark. However, without the proper experience and tools, many of these aspiring business owners struggle to make it through the tough initial startup stages.

Hayder Alla’ Abdulzahra is a motivated young Iraqi entrepreneur who is committed to making a difference. On top of his professional roles as a dentist in the public sector and brand manager for his family’s creative agency, Hayder is preparing to launch his startup: an app that will facilitate Iraqis’ access to medical services.

Hayder Alla’ Abdulzahra is a motivated young Iraqi entrepreneur who is committed to making a difference. On top of his professional roles as a dentist in the public sector and brand manager for his family’s creative agency, Hayder is preparing to launch his startup: an app that will facilitate Iraqis’ access to medical services.

16 May 2023, Hiroshima, Japan - Tim is a non-resident fellow of the United Nations Institute for Disarmament Research (UNIDIR). Before joining UNIDIR, he served as the Director of the United Nations Office for Disarmament Affairs in Geneva, Deputy Secretary-General of the Conference on Disarmament, and Disarmament Ambassador and Permanent Representative of New Zealand to the United Nations in Geneva.

15 May 2023, Hiroshima, Japan – Since she was a high schooler, Dr Marwa Nofal was interested in the interactions between people. Wanting to learn more about human behaviour, she pursued medicine and psychiatry in her undergraduate and graduate studies. Marwa is now a psychiatrist at a public mental health hospital in Egypt, where she provides therapy to clients and conducts research.