As part of the AGFUND and UNITAR Global Learning Platform on Financial Inclusion initiative, two e-workshops were organized to enhance the capacities of professionals in the areas of financial inclusion and sustainable development. The e-workshops "Financial inclusion and sustainable development" and "Training of Trainers for financial inclusion" were delivered in November and December 2020, over four weeks each. The e-workshops targeted professionals working in microfinance or financial institutions from the Middle East and North Africa (MENA) and Sub-Saharan Africa (SSA).

The main objective of the e-workshop on “Financial inclusion and sustainable development" was to provide participants with a better understanding of the interactions between financial inclusion, economic growth and sustainable development, as well as how to build long-term success in financial inclusion to contribute to the fostering of long-term value creation. The e-workshop also emphasized how digital finance spurs inclusive growth by leading to greater efficiency and new business models, highlighting the context of the COVID-19 pandemic.

The "Training of trainers for financial inclusion" e-workshop focused on equipping participants with the necessary knowledge and skills to design and conduct training in the area of financial inclusion. The course content covers information on training and participants' needs, training design, learning styles and principles of adult learning, drafting and evaluating learning objectives, and communication and presentation skills.

The e-workshops welcomed 195 participants: 103 from the e-workshop on financial inclusion and 92 from the training of trainers (ToT). Participants came from 39 countries from the MENA region and SSA, primarily based in Kenya, Nigeria, Lebanon, Ethiopia and Uganda. Figure 1 shows the participants’ countries of origin. It is worth mentioning that 38 participants enrolled in both e-workshops.

Self-evaluations conducted after the completion of the e-workshops showed a higher proportion of participants for whom the information was new and relevant to their job success in the ToT e-workshop compared to those participating in the “Financial inlcusion and sustainable development” e-workshop. But, similar intent to apply the skills in their workplace. For the ToT, 95 per cent of respondents to an online survey considered the workshop’s content relevant to their job and a similar 91 per cent intended to apply the knowledge and skills to their job. For the e-workshop on financial inclusion and sustainable development, these rates are 88 per cent on job relevance but 93 per cent for intent to use.

This Impact Story showcases participants’ application of knowledge and skills six months after completing the e-workshops and discusses opportunities and challenges associated with applying knowledge and skills. The story is informed by feedback obtained from an online survey and in-depth interviews with four participants [1].

[1] An impact story of the AGFUND-UNITAR online courses on financial inclusion can be found on our website at the following link: https://unitar.org/about/news-stories/stories/prosperity-enhancing-capacities-financial-inclusion-through-online-courses

Application of knowledge and skills from e-workshops

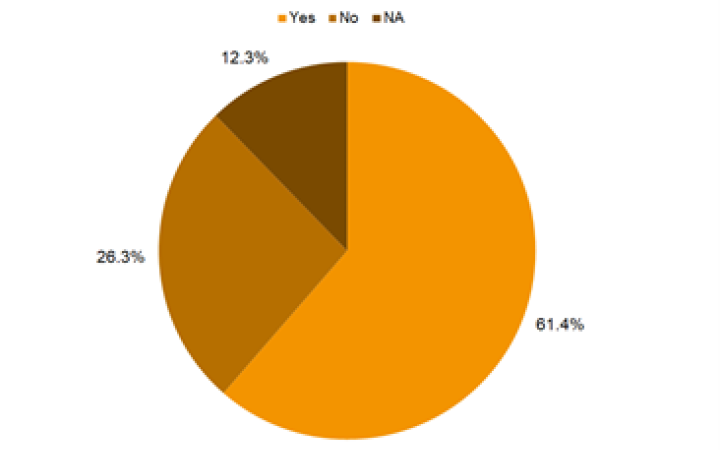

A participants survey was conducted to better understand the potential changes in participants' professional lives derived from the e-workshops. Fifty-seven responses were collected, corresponding to a 36 per cent response rate. Most of the respondents (61 per cent) were working in an institution or area related to financial issues or financial inclusion. Figure 2 shows this distribution. The rate of participants directly working on financial inclusion or financial issues in general, was higher for those who took part in the e-workshop on financial inclusion and sustainable development (64 per cent) compared to participants from the ToT (59 per cent).

Furthermore, the main work responsibilities of participants from the e-workshop on financial inclusion and sustainable development are directly linked to the topics covered by the training. Seventy per cent of the survey respondents confirmed that their work is related to the areas of financial inclusion, digital finance, sustainable development or economic growth. Similarly, 73 per cent of respondents who participated in the ToT had already experience and some participated in previous training on learning methodologies techniques, communication and leadership skills or other skills relevant for delivering training.

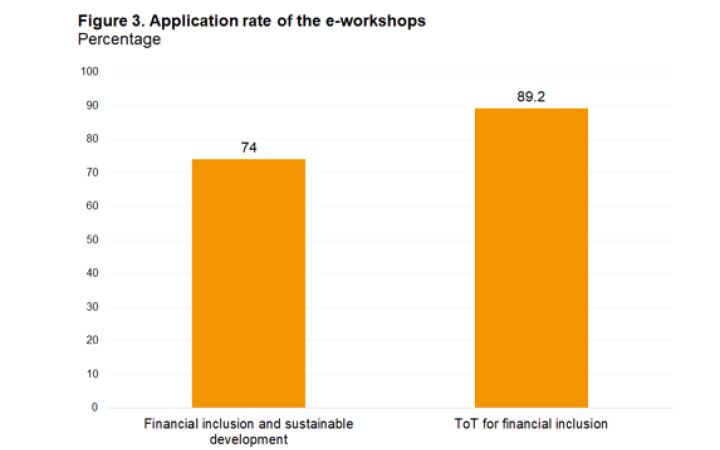

Although for both e-workshops participants were working in areas related to the training content, the application rate was higher for those participating in the ToT. Figure 3 shows the e-workshops application rate. From ToT e-workshop respondents, 54 per cent indicated to have conducted training multiplications or incorporated skills from the e-workshops when delivering training, while the remaining 35 per cent have incorporated knowledge from the training into their daily work but not conducted or designed any training themselves. Examples of these applications include incorporation of new knowledge to academic assignments, informal knowledge sharing at work, presentation skills for presentations at the workplace, team building techniques and new project/activity proposals at work based on the knowledge from the course. Additionally, most of those who have conducted trainings after the e-workshop had previous experience as trainers or received previous related training (85 per cent).

Interestingly, for the e-workshop on financial inclusion and sustainable development, there are several examples of applying knowledge associated with innovations. These can be summarized in financial products to promote sustainable agricultural practices, mobile money cash transfer, strategic agro-finance, massive collection of revenues and mobilization of funds and savings. However, application has also included the elaboration of manuals, research materials or other informational material related to financial inclusion and informal knowledge sharing.

In line with previous training experiences, participants from the ToT showed a lower attribution rate of their application of knowledge to the UNITAR-AGFUND training than those in the other e-workshop (i.e., those who have participated in previous trainings attributed a lower proportion of their application of knowledge to the UNITAR-AGFUND training). Participants in the e-workshop on financial inclusion and sustainable development attributed, on average, 69 per cent of the application to the e-workshop, while it was 62 per cent for respondents attending the ToT.

The importance of knowledge to job success, training design and methodologies and sufficient knowledge to be applied were the principal enabling factors of application of knowledge and skills from the two e-workshops. On the other hand, not having the opportunity to use the knowledge and skills, lack of support from their supervisor at work and lack of time were the main factors preventing participants to apply knowledge and skills from the training further.

Regarding training design, the e-workshops included interactive components such as peer-review exercises and working groups. Of the 57 respondents, 22 indicated they still have contact with other participants. Some examples and information from the semi-structured interviews conducted for this Impact Story suggest that some participants created WhatsApp groups for the working groups and stayed in contact after that and by email.

Yahaya Balla

- Finance manager at Islamic Relief Worldwide - Sudan

- Financial inclusion through fintech solutions

Khartoum, Sudan. Yahaya is a professional in the area of finance, auditing and programme analysis. He is originally from Niger but is currently working in Sudan at Islamic Relief Worlwide as the organization's finance manager. Before the e-workshops, he was working as a consultant on a project related to microfinance and SMEs. It was in this context that he decided to strengthen his knowledge in this area, first by taking the AGFUND-UNITAR "Leadership skills for finance managers" course and later the two e-workshops on financial inclusion. He was able to use his free time during the global COVID-19 pandemic for learning. Although Yahaya switched jobs soon after completing the e-workshops, he has incorporated some of the knowledge from the training into his new tasks.

The projects managed by the organization are focused on the areas of health, emergency, food security and livelihoods, and many of them involve a provision of cash to beneficiaries. Even if he is not directly involved in project management and implementation, as a finance manager, he is constantly in the meetings with the programme department and can share ideas with the teams. The organization is currently managing a project that includes cash provision to internally displaced Peoples (IDPs) and refugees from Ethiopia in Sudan, in partnership with many UN agencies (IOM. UNDP, UNICEF, WFP).

In this context, Yahaya was able to suggest some ideas that could help to increase efficiency in the projects and improve the safety of the beneficiaries. Yahaya remembered from the e-workshop the content on financial technologies and proposed to use mobile solutions to make the payments to the beneficiaries instead of using cash. To do so, he suggested partnering with a financial institution to operate this proposal. Currently, the organization is partnering with the Bank of Khartoum (BOK) and a telecommunications operator to implement the idea. Yahaya now recognizes that the project is more efficient by reducing the delivery time from one month to one week and even more transparent since they can receive the payment confirmations through the telecom company directly and present them to the donors as evidence. More importantly, the beneficiaries and the staff are now safer from any attack or robbery since they do not need to handle large amounts of money in cash. Yahaya states that the idea came from the e-workshop and that positive reactions from colleagues have further enabled him to implement it.

Multiplication of the training from the ToT has been more challenging as his office (finance) is not fully engaged in this field but could use training needs assessment tools to train local partners in financial reporting. However, Yahaya plans to conduct some learning sessions with local NGOs on procurement, payments and non cash-item distribution. Although Yahaya was doing this even before the training, he now feels more confident by implementing formal training methodologies into the learning sessions.

A driver for learning for Yahaya was the group work, where he had the opportunity to immerse in a case study (Sierra Leone) and learn from the experiences of other professionals around the world. Moreover, he is still in contact with the group through a WhatsApp group where they still exchange ideas. Yahaya hopes there would be more opportunities to participate in similar training with AGFUND-UNITAR in the future.

John Mathia Irungu

- Finance manager at a financial services company

- Sustainable finance initiatives for Sustainable Development

Nairobi, Kenya. John is an experienced professional on financial issues. He holds a bachelor's degree in business administration with a concentration in finance and an MBA also focused on finance. He is also a certified public accountant (CPA) in Kenya. John is currently working as the finance manager in a company that provides microloans to SMEs suppliers. Their clients are usually (but not uniquely) in the retail sector, as illustrated in this story. John was wanted to learn how the financial sector was operating in other countries, especially in other African countries, to gather ideas that could help him innovate in his work and to expand his professional network. That is why he first enrolled in the "Fundamentals of the financial system" online course and later in the "Financial inclusion and sustainable development" e-workshop John attributes his new ideas to implement his work to the e-workshop, however.

When taking the e-workshop, John was touched by the topics on sustainable and green microfinance and realized that he could propose a new product at work with this at its heart. John and his team are currently innovating on a new financial product for the agricultural sector, called "supplier loans". The proposal has two components: i) connecting procurement entities of agricultural products with farmers to supply them; and ii) offering flexible microloans to farmers that allowed them to develop productive activities to supply the companies. These microloans have lower interest rates than those offered in the market and shorter repayment periods (three to four months). It also uses the farmer's transactions with the procurement institutions as collateral instead of their assets (e.g., deeds), as usually done in other financial institutions.

John recognizes that most of these farmers might not be able to apply for a microloan in other institutions due to the lack of collateral but the novelty of their proposal is to use an alternative solution (i.e., agreement with buyers) that also helps the farmers introduce their product in the market. This alternative has also proved to be useful, since farmers sometimes experience cash flow problems since most of the contracts are paid after the product is delivered and also face difficulties in obtaining the necessary money to start their activities. John and his team had already started making disbursements to 35 farmers. He attributed this idea to the e-workshops as he first learned about the concepts during the training.

A critical factor that helped John to propose and develop his idea was the support received from his supervisors and colleagues at work. John describes a very good and enabling environment at his workplace, where employees are incentivized to propose new and innovative ideas. John also feels fully confident to put into action what he learned during the training. He considers another important factor was his motivation to think out of the box. When taking the e-workshop, John went beyond the course material to further research the new topics of sustainable and green microfinance.

Unfortunately, John has not continued conversations with other participants as he would have expected. However, he still considers the discussions during the training very fruitful and helpful to learn from other professionals in the field.

Ogechi Lawrence-Onyemah

- Head of Office and business development for public sector and social programmes

- Financial technology for boosting inclusion

Nigeria. Ogechi is the head of office in a private company working on business and product development and innovative digital payment strategies. She has some 15 years of experience in e-banking, business development and fintech solutions. Part of her work is to provide digital payment solutions according to their client's business needs. Aware that "financial inclusion is embedded in fintech solutions", Ogechi wanted to gain more knowledge on the topic and decided to apply for both AGFUND-UNITAR e-workshops on financial inclusion. Ogechi has incorporated knowledge and skills from each of the e-workshops, including developing capacities of her team and improved work performance.

Most of Ogechi’s clients are humanitarian sector organizations working to bring final beneficiaries mostly from the agriculture, social protection and livelihoods sectors, to the financial ecosystem. Although most of their clients (around 70 per cent) operate in Nigeria, others have a broader geographical coverage to other countries in Sub-Sarahan Africa. Ogechi's company serves as a digital financial services provider for them. Ogechi feels that after the workshop, she is better positioned to advise and discuss with her clients on possible alternatives to address the final beneficiaries' needs. Having a better understanding of financial inclusion has helped her propose alternatives on including the final beneficiaries into the financial system, such as forming community groups to combine savings and loans. Also, the e-workshops included country case studies that helped Ogechi access information on regulations and policies governing the sector.

Ogechi has also applied some knowledge and skills from the ToT. After finishing the e-workshop, she developed three training sessions to share information from the training-one with her colleagues and two with final programme beneficiaries. The communication and presentation skills acquired during the ToT have also boosted Ogechi's confidence, as she now feels more confident about how to address others, speak in a conference or engage in a panel discussion with her clients.

A very valuable element of the training for Ogechi was the working group. Hearing different experiences and expertise levels of the group members helped Ogechi better understand the different needs and priorities they were facing in their organizations. Moreover, she has stayed in touch with her classmates with whom she occasionally shares professional information.

Olufemi Olakunle Ajayi

- Education expert

- Training on financial inclusion

Lagos, Nigeria. Olufemi is a life-long learner with expertise in education, management, leadership and conflict settings. He holds a bachelor's degree in conflict management and a post-graduate diploma in conflict management and resolution and has written seven books. He has taken more than thirty courses and training in different areas, including several UNITAR courses. Despite his longstanding participation in learning events, including other AGFUND-UNITAR courses on financial inclusion, Olufemi considers that the e-workshop on ToT has helped him improve his abilities in delivering training.

Olufemi had been a secondary school director for the last seven years. His participation in the e-workshop opened the opportunity for Olufemi to deliver training sessions on financial inclusion to other school staff as a consultant. With this, he could multiply the training received during the ToT, including communication and presentation skills acquired during the e-workshop. During this process, he consulted the training manuals he obtained from the e-workshop and transformed the online training session into a face-to-face format. Olufemi appreciates this opportunity of transferring knowledge to others as he believes that teaching is one of the best ways of learning something.

Although not precisely on financial inclusion, Olufemi has also used knowledge from the ToT to deliver training in the school he was working. He regularly conducts training sessions focused on educational issues such as classroom discipline. During these sessions, he would directly apply the skills with his staff and teach them how to manage a group and how to better communicate with the students. Moreover, he has also applied some technical knowledge from the AGFUND-UNITAR courses to his personal life. For example, Olufemi could negotiate a loan restructuring process with his local bank, given some mobility restrictions during the COVID-19 lockdown. He says he learned about these possibilities during the online courses.

Olufemi feels fully confident to continue applying the knowledge gained during the e-workshop – and other AGFUND-UNITAR online courses. Olufemi would love to continue facilitating training sessions on financial inclusion but recognizes that he lacks the resources needed to develop and deliver courses all by himself. For the next few years after finishing his work as a school director, Olufemi would like to act as a trainer for UNITAR or other organizations in the area of strengthening capacities. He is still in contact with some of the trainers from the e-workshops and has consulted them on the training materials.

Conclusion

As this Impact Story has shown, the AGFUND-UNITAR e-workshops participant have experienced changes in their profesisonal lives, with 64 and 69 per cent of workshop respondents attributing the changes to their particiaption in the training. As illustrated by participants in the survey and interviews, the focus on digital solutions in the e-workshop on financial inclusion and sustainable development helped participants to experience new alternatives and solutions to the challenges presented at work to reach those with greater barriers to access the financial system. Digital finance and fintech solutions were angular to participant's work with different applications. Participants have proposed new solutions leading to more efficient and transparent/accountable processes in their organizations.

The ToT for financial inlcusion has also produced changes at work, even when training multiplications did not occur. The story has found that multiplications of training usually occur when participants have previously delivered training or have participated in training addressing some of the content covered in the ToT. Moreover, participants have been able to create capacities mostly in the area of financial inclusion, with one example of a ToT for rural cooperatives.

The training methodologies used in the e-workshops, including the group work exercises, prove to be effective for participants’ application of knowledge and skills at their workplace. The interactive nature of group work also helped participants strengthen their professional networks.

Evidence from this and a previous Impact Story on the AGFUND-UNITAR online courses indicate that there is high demand for training on financial inlcusion (in both cases applications were higher than expected). The stories bring to light visible results and the expression of participants to continue their learning in this area.