30 March 2021, Geneva, Switzerland - From 29th to 30th March 2021, UNITAR, ESCAP, UNDP, and UNDESA teamed up for a virtual training on the Integrated National Financing Frameworks (INFF), held over 3 half-days. Titled “Integrated National Financing Frameworks (INFF) and Budgeting for the 2030 Agenda: Financing Sustainable and Inclusive Recovery”, the first day took a deep dive into the INFF building block on integrated financing strategies, including country cases and practical experiences based on DFA findings. The second and the third days focused on the alignment of budgeting processes with nationally determined SDG priorities. 382 participants attended the training sessions, coming from 39 Asia-Pacific and 7 other countries working in national governments, UN and international organizations, think tanks, civil society organizations, private sector, and academia.

The first day of the training comprised of welcoming remarks by senior leadership and various introductory remarks. It began with opening remarks by Mr. Nikhil Seth (Assistant Secretary-General and Executive Director, UNITAR), Mr. Kaveh Zahedi (Deputy Executive Secretary, ESCAP), Mr. Christophe Bahuet (Deputy Regional Director, UNDP Asia and the Pacific), and Mr. Navid Hanif (Director, Sustainable Development Financing Office, UNDESA), who mutually stressed the importance of INFFs in guiding countries on their path to recovery from the COVID-19 crisis and building back better towards the 2030 Agenda. They agreed that INFFs, therefore, would have an important role in the immediate crisis response as well as long-term recovery, by streamlining national budget planning in accordance with the SDGs. Mr. Seth and Mr. Zahedi particularly emphasized the need to investigate tax administration, public spending capacity, private sector’s engagement, and that budgeting strategies must incorporate prudent debt management. Mr. Bahuet noted that the primary challenge is to create a global financial system that can channel the finances towards recovery, and Mr. Hanif focused on how risk-informed financing policies would lead to financing for resilience.

The welcoming remarks were followed by an overview of the learning objectives of the training, and of the INFF implementation in the Asia-Pacific region. Ms. Elena Proden (Senior Specialist, UNITAR) went over the learning objectives, which ranged from the opportunities and challenges countries might face with the INFF, to the implementation strategies and good practices of this process. Ms. Emily Davis (SDG Finance Specialist, UNDP), then took the floor to present how countries in the Asia-Pacific region were responding to the INFF and innovatively strategizing their development plans accordingly. She mentioned that more than 70 countries were operationalizing the INFF, out of which 22 belong to the Asia-Pacific region. The financial crisis created by COVID indicates that there is now a need for integrated financing than ever before. She further explained that the INFF would be crucial to fill the gap in most national development strategies – a financing strategy that goes beyond public financing mechanisms. She then elaborated on the results of a survey conducted by UNDP on the national financing strategies and DFAs (Development Finance Assessments) of various Asia-Pacific countries and went on to shed light on the INFF progress of some of these countries.

Ms. Natalja Wehmer (Economic Affairs Officer, ESCAP) then took the floor to link the INFF with the key messages from the 8th Asia Pacific Forum on Sustainable Development (APFSD), pointing out that the region was yet to meet its 2020 SDG progress. Ms. Wehmer gave the participants an overall picture of the discussions around relevant SDG roundtables during the APFSD.

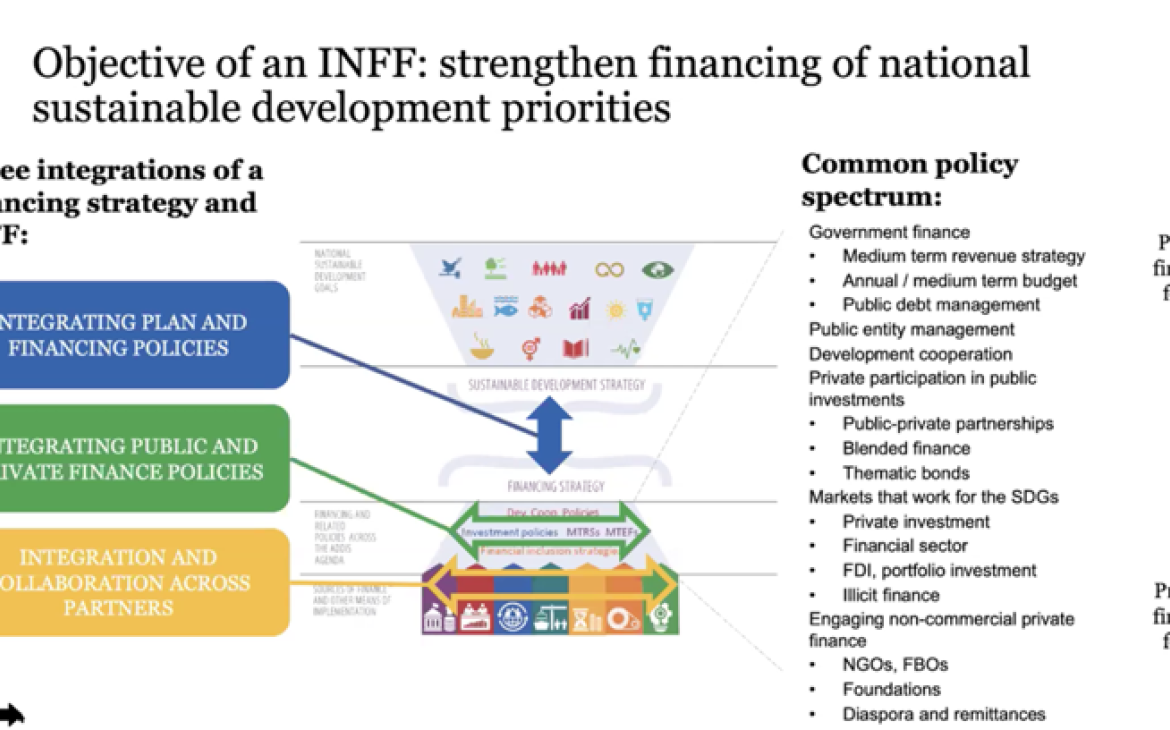

Ms. Sarwat Adnan (Regional Cooperation Frameworks and Partnerships Officer, UNDCO) then opened the first training session featuring examples of countries that have leveraged the INFF, including Timor-Leste, the Maldives, Indonesia, and Mongolia. Before zooming into country experiences, Mr. Yanis Kuhn von Burgsdorff (Economic Affairs Officer, UNDESA) introduced the INFF and financing strategies, and walked the participants through the steps of implementation, stating the pivotal role of INFFs as bringing together existing tools and frameworks in a coherent, sustainable and risk-informed manner. The first country presentation of the workshop was presented by Ms. Mariyam Manarath Muneer (Senior Policy Director, Ministry of Finance, Maldives), on how leveraging the INFFs has guided the transformation of financing strategies. She mentioned that despite COVID19’s challenges, the INFFs and DFAs have assisted in focusing more on climate, environment, economic diversification, equality, and inclusivity in job creation and health, and have become more resilient as a result. Medium-term targets are looking closer and plan to be achieved over the next 3 years. She also added that the APFIN’s approach of south-south cooperation on knowledge sharing has helped develop a common understanding essential to tackle similar challenges faced in the region. This was followed by the country presentation by Dr. Vivi Yulaswati (Expert, Ministry of National Development Planning for Social Affairs and Poverty Alleviation, and Head, National Secretariat for SDGs, Indonesia), on the design and implementation of the INFFs in Indonesia. Development Financing had been a challenge since even before the COVID-19 Pandemic, which took a further downturn with the pandemic. Due to the imperative need for a holistic approach to financing strategies, Indonesia has focused on innovative financing and public-private partnerships, green sukuk and bond, and other forms of philanthropic and crowdfunding sources. Indonesia would be presiding over G20 in 2022, which is also increasingly supporting the INFFs, which has resulted in governments integrating the INFF approach to their processes as well.

After a step-by-step outline of the IATF guidance on Financing Strategies by Mr. Burgsdorff, countries presented their experiences with these mechanisms. Ms. Brigida Brites Soares (Coordinator of Planning, Monitoring and Evaluation Unit, Prime Minister’s Office, Timor-Leste), presented the challenges of financial diversification in Timor-Leste. She mentioned one of the key reforms that have taken place in Timor-Leste is the nationalization of SDGs as part of the Planning Framework. Further, she explained that the added value of the INFF was uniquely that of the holistic approach, connecting decision-makers from top to bottom institutions. Another interesting case was presented by the UNDP Country Office of Mongolia, by Ms. Enkhzul Dambajantsan (National Project Coordinator). Mongolia started with their INFF journey in 2018 with the DFAs, and is currently being developed in addition to SDG prioritization and costing exercise, and INFFs and financing strategies and operationalization, under Mongolia’s “Vision 2050”. Ms. Dambajantsan presented Mongolia’s financing landscape assessment to explain the identified gaps in resource mobilization and approaches to mobilizing new resources and efficiency. The contribution of the INFF and DFAs to form a comprehensive holistic approach was evident in both cases. The first day concluded with Mr. Tim Strawson (SDG Finance Specialist, UNDP) etching out the DFA’s relation to the INFF, emphasizing the centrality of dialogue and multi-stakeholder partnerships.

March 30th, the second day of the training, began with an overview by Mr. Asad Makhen (Public Finance and Governance Specialist, UNDP), throwing light on the integrated approach that is pivotal to planning and budgeting for governments to achieve SDGs. Public finance management, he said, is an effective vehicle to understand how SDGs can be included in the planning and budgeting phase and increasing accountability. The session focused on a key element of the INFF – public finance and government budgeting. This session addressed fundamental questions on how to anchor SDG-aligned budgeting in national frameworks, and how to strengthen the role of parliaments in this respect.

The session began with Ms. Proden’s presentation on the alignment of budgeting with SDGs by fostering deeper policy coherence. She emphasized the need for streamlining resource allocation, implementation activities, M&E frameworks, and regular reviews and reporting to achieve this objective. Budgeting better aligned with strategic planning and SDGs could contribute to strengthening conference and effective policies in other ways: by providing a long-term perspective through MTEFs, shifting focus beyond electoral cycle, focus resources on “accelerator” areas, better-reflecting synergies and trade-offs in resource allocation, etc. The floor was then passed to Mr. Phiri McCarthy (Consultant, UNITAR), and Mr. Suren Poghosyan (Senior PFM Specialist, UNDP) who presented the budgeting processes and selecting the right model using UNDP’s approach respectively. More specifically, Mr. Poghosyan presented an approach proposed by UNDP that aims to enable countries at different stages of PFM reform and with different institutional set-ups to make progress on better aligning budgeting with SDGs.

A fruitful discussion followed these presentations as participants were invited to form country groups in break-out rooms and discuss their country’s context; which of the four base models may be appropriate in their case in a short run and why; and in what respect this exercise may have been helpful to them. Each group then presented their deliberations in the plenary discussion, incl. Tajikistan, Armenia, Bangladesh, Uzbekistan, Mongolia, and Malaysia. All country discussions seemed to agree that all stakeholders should be consulted, parliamentary involvement is essential, and that public finance management was key to enabling SDG and development mapping strategies. These discussions proved to be an organic segue into the next session on Strengthening the Role of Parliaments in SDG budgeting and oversight by Ms. Proden. The session ended with an insightful case study from Pakistan, presented by Mr. Asif Shah (Regional Public Finance Advisor, UNDP Pakistan) on strengthening parliamentary oversight for SDG-aligned budgeting. He began by asserting that the political economy’s informal institutions were central to this attempt at aligning the budget with the SDGs, and that overall budget scrutiny was incomplete for multiple reasons, including mismanagement of time and schedules, lack of institutional support, procedural deficits in operational framework and local politics. This showed the centrality of parliamentary involvement in successful recovery planning and budgeting. Mr. Shah also focused on climate budget tagging, which is not only part of the broader SDG Agenda, but also serves as a “transversal model” for SDG monitoring and oversight. The Parliament in Pakistan has now adopted SDGs as the national strategy for development, including provincial legislatures. The session adjourned with a Q&A Session, where participants discussed the awareness of SDGs among parliaments, instruments to link parliamentary processes with SDG-aligned budgetary planning, and strengthening parliamentary capacity for the same.

The same overarching theme continued on March 31st, 2021, the third day of the training session, which began with a case study from Mongolia, presented by Ms. Munkhtuul Batbaatar (National Project Coordinator, UNDP Mongolia) and demonstrating the application of UNDP methodology described one eve in a specific country context. She further explained that the acceleration of SDGs and establishment of performance indicators were being done via a robust evolution of budgeting processes, involving legal changes, improvement of budgeting infrastructure, and program budgeting experience. She also explained that the Leaving No One Behind agenda was a key driving force, as well as an essential objective, underlying these transformations, including Mongolia’s development agenda for 2030. Ms. Batbaatar emphasized the primary aim of these evidence-based changes was two-fold – to have improved budget formulation, and also strengthened budget oversight and transparency. This final session then moved to discussions on the takeaways from this workshop, and the further steps countries would be taking to meet their gaps, needs, and other challenges, moderated by Ms. Davis. Bangladesh, The Philippines, Afghanistan, Indonesia, Mongolia, and Micronesia representing Pacific Islands, presented their reflections on these questions. The countries appeared to be unified by the idea of involving multiple stakeholders including citizens and civil society organizations, the importance of budgetary planning to be aligned with SDGs for more coherent methodology and monitoring, and the required transformation in their respective public finance institutions and strategies with guidance of the INFF.

As the session moved towards conclusions, Ms. Wehmer talked about the countries where INFF has been implemented and the robust structure of international partnerships underlying the structure of INFF. In conjunction, Ms. Davis also added that the platform will also provide the latest news updates, networking opportunities to connect with INFF experts or organizers, for specific questions or country cases, and the feature to share the country’s own experiences with the INFF through events, reports, and other information, keeping with the structure of a collaborative partnership. This also includes the APFIN (Asia-Pacific SDG Financing Facility) that supports SDG country financing strategies for the 2030 Agenda, with technical assistance and knowledge generation. Closing remarks by Mr. Burgsdorff reiterated that the INFF attempts to make counties informed and acts as a check for other facilitators like the UN. Mobilizing financing in the current context and complex issues around financing like risks and constraints in policymaking, he said, are some of the key concerns INFF seeks to address. Ms. Davis acknowledged that using financing strategies to address the recovery plans was a key takeaway from this training, and how this could be translated to practice including collaborations with various parliaments, to strengthen the INFF at the country level. Ms. Wehmer and Ms. Proden closed the session by addressing the gaining traction of the INFF, and the hope for fruitful partnerships to continue, as they are the foundation of the INFF.

Participants have found the training extremely useful (94%) and that would recommend the training to others (91%). The training has applied several types of evaluations including perception-based assessment through polling and final evaluation as well as objective assessments through an ex-ante and ex-post test. The comparison of before and after test results showed that participants have increased their knowledge and skills by 10%, that on Financing Strategies the knowledge and skills of participants increased by 10%, and on SDG-aligned Budgeting by 14%.

After the success of this training and the previous training held in January 2021, the UN partners plan to deliver other products from the pipeline, such as regional and sub-regional virtual training events, e-learning modules, guidance material, and other tools and knowledge products.