Featured Article

November 2021 - This article brings some light into the black box of how the transition can be tackled in practice, and is written by Eliya Devay, graduate of the UNITAR-Franklin University Switzerland Joint Master’s programme in Responsible Leadership & Climate Action. Eliya is specialized in Sustainable Finance and currently works at the United Nations Environment Programme Finance Initiative (UNEP FI) as a Consultant.

In light of the recent COP26, this article features outcomes and reflections from Eliya's experiential learning project with UNEP FI, as part of his Master's graduation degree programme, and of his current work as a consultant. UNITAR features this article to highlight the follow-up work of a graduate in the joint Master's programme with Franklin University, and whose article will appear in the next newsletter of the UN Global Compact.

Introduction

159 companies are responsible for 80% of global corporate greenhouse gas emissions. Most of them don’t have all the answers on how to finance and achieve the targets they have set. This blog brings some light into the black box of how the transition can be tackled in practice.

In interviews with Chief Financial Officers and Chief Sustainability Officers of global companies the answer was more than once: “Your questions about reaching Net-Zero emissions are good and relevant. But we don’t have all the answers to them neither.”

The benefits of ‘why’ adapting the business to climate change for companies is clear. The challenge is, ‘how’ to reach Net-Zero emissions throughout the value chain to mitigate the material risks that climate change poses.

Now here comes the crux of the matter. Companies started to pledge for Net-Zero emissions, but there is a major black box on how to finance this transition. The next sections try to shed some light onto 5 interconnected areas influencing the financing of the transition:

- Price: How much does a company has to invest for the transition?

- Roadmap reporting: Does what gets measured really get managed?

- Carbon emissions: How much can a global company offset?

- Manage the relationships: How will companies support the transition of their suppliers?

- Accounting: How can a company brace itself for carbon pricing policies?

The blog includes examples in the FMCG industry to underline the findings, but applies to other industries equally.

#1 Price: Companies don’t allocate the capital needed for Net-Zero

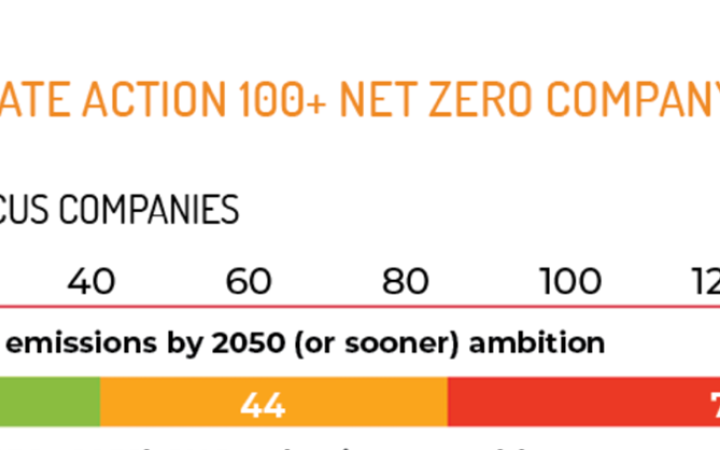

None of the 159 biggest corporate emitters have committed to align their future CapEx with the goal of the Paris Agreement to limit temperature rise to 1.5°C. The current state-of-the-art ‘Net-Zero Company Benchmark’ of ‘Climate Action 100+’ assessed the largest corporate greenhouse gas emitters in the world and demonstrated this unimaginable finding. Most companies have sustainability reports and roadmaps with actions they want to take towards Net-Zero. But this is not enough, if the capital is not aligned with them.

One could state that many companies invest into sustainability projects or they prepared funds for climate projects like Unilever PLC or Nestlé SA announced recently. Breaking open the assessment indicators of the above-mentioned benchmark points at the issues with the capital:

- Indicator: Future CapEx alignment

A. The company explicitly commits to align future capital expenditures with the Paris Agreement’s objective of limiting global warming to 1.5° Celsius.

0 of 159 companies

B. The company explicitly commits to align future capital expenditures with its long-term GHG reduction targets.

6/159 companies

- Indicator: Methodology for alignment

A. The company discloses the methodology it uses to align its future capital expenditures with its decarbonization goals, including key assumptions and key performance indicators (KPIs).

0 of 159 companies

B. The methodology quantifies key outcomes, including the share of its future capital expenditures that are aligned with a 1.5° Celsius scenario, and the year in which capital expenditures in carbon intensive assets will peak.

0 of 159 companies

Only six companies have committed to align their future CapEx with their long-term emission reduction targets. None of them has committed to align future CapEx to stay within the 1.5°C temperature rise.

Although capital is invested into delivering their sustainability targets, how do the companies know if it is enough to reach Net-Zero and if it makes a meaningful difference to the environment? The companies have not disclosed the methodology they used to align their future CapEx, which emphasizes this problem. Research has shown that the published sustainability reports and roadmaps of the companies do not communicate the costs transparently. Even in the financial statements, there is no separate disclosure on how much the sometimes very ambitious and elaborated roadmaps fully cost.

The reasons could be manifold; from not-knowing how to measure the full extent, to not wanting to frighten the investors with the large sums, or that the financial business cycles are short-termed making it difficult to suddenly create a long-term outlook.

#2 Sustainability roadmap: What gets measured does ‘not’ get managed

Stephanie Pfeifer, CEO of Institutional Investors Group said: “Whilst ambitious targets are critical, they are not enough on their own and be underpinned by credible strategies to achieve them.”

The findings of the ‘Net-Zero Company Benchmark’ of the largest carbon emitters underline this statement. Around 50% of the assessed companies announced the intention to achieve Net-Zero by 2050 or sooner. However, half of these companies don’t cover the full scope of their most material emissions.

This becomes visible when comparing Unilever PLC and Procter & Gamble Co., which are both part of the benchmark. P&G announced that they want to reduce their emissions from their operations (=Scope 1 emissions) by 50% until 2030. Which sounds great at first, but counts only for 2% of the emissions of P&G. The other 98% of their emissions are indirect, or so-called Scope 3 emissions. For this major part of their carbon footprint, they have not set any explicit targets. In contrast, Unilever has set a target to reach Net-Zero by 2039 across Scope 1, 2 & 3 emissions.

P&G and other companies could see the division of scopes as justification to not take responsibility for all their emissions. In particular Scope 3 emissions, as they arise outside the ownership of a company. However, the company is responsible for these emissions as they occur within their value chain and they can influence it directly.

The saying goes: What gets measured gets managed. Looking at the past of P&G, this is not the case; and they are not the only ones. Even though they measured their emissions for several years, their Scope 1 emissions rose by 10% in the last 5 years. Measuring emissions is helpful in creating awareness within a business, but does not implicate action. Ambitious targets are not enough, a credible strategy with clearly defined actions must follow.

#3 Carbon emissions: The capacity to offset emissions is overestimated

All the strategies of the companies that are committed to achieve Net-Zero follow the same approach: Reduce carbon emissions throughout the value chain and offset residual emissions.

Unfortunately, the capacity to offset emissions is limited and cannot work as a solution on a large scale. The process to offset emissions is called ‘Carbon Capture Usage and Storage’ (CCUS). There are technological solutions such as Direct Air Capture or nature-based solutions like planting trees.

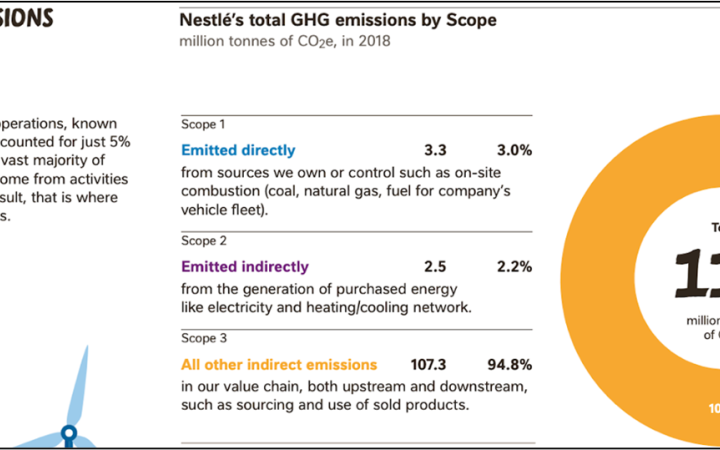

The technological solutions are a growing market, but currently still too expensive to use for companies. Offsetting 1 ton of CO2 equivalent (CO2e) this way costs up to $670. For a company like Nestlé with a carbon footprint of 92 million tons of CO2e this would cost more than $60 billion, if they would offset all their emissions through this technology.

Nature-based solutions do not need further technological development, which makes them outright accessible. However, there is an issue with this solution over which there is little awareness. There is a limited capacity for tree-planting. The United Nations calculated that there are 500 million hectares available for planting new trees currently. Royal Dutch Shell PLC recently announced to plant trees in the size of Spain to offset their emissions. Spain has the size of 50 million hectares, meaning that one single company would take up 10% of globally available nature-based offset space.

The intentions of the companies considering carbon offsetting are to be welcomed, but only as a last measure. The high price of offset technology and the limited capacity of nature-based solutions limits their usability on a large scale. This unveils the reason why most companies must reduce their emissions as much as possible before considering offsetting.

#4 Relationships: Managing the transition with the suppliers

There are more challenges laying in Scope 3 emissions. Across industries, 85% of the emissions fall into Scope 3, in some industries even much more, as the example of Nestlé SA shows:

The actions required to mitigate Scope 1 and 2 are straightforward, but more difficult for Scope 3. One of the biggest challenges remains how a company can transition its suppliers to low-carbon.

For companies in the FMCG industry they face another challenge – the farmers producing the raw materials have little motivation for reducing emissions, and in many cases do not have the resources to do so. The difficulty becomes visible with the sheer extent of suppliers of Philip Morris International Inc: They have contracted 335’000 tobacco farmers, which all fall into Scope 3 of the company. How will companies support their suppliers to do so?

Excursion: How does Philip Morris International manage their transition with their suppliers?

When measuring the Scope 3 emissions, Philip Morris International (PMI) identified the processes that are most carbon intensive and present the biggest reductions at small cost.

One of them is the drying process of the tobacco, called curing, which is realized by their farmers. The farmers did not have an incentive to decarbonize it. But improving the curing, reduced the carbon footprint while increasing the income of the farmer too.

Curing tobacco means hanging the leaves into curing barns, where heated air is generated to dry them. Over a third of the supply chain emissions originated from this process.

The first step was to improve the insulation of the curing barns to decrease the loss of heat, which leads to a reduction of the fuel consumption. The next step was connected to the energy source to heat the barn. To heat the curing barns, coal, diesel, natural gas, firewood or biofuels can be used. By switching from fossil fuels to biomass fuels and using sustainable firewood the carbon emissions were further reduced.

The costs for this transition were relatively low. The company has 2875 field technicians, which are monitoring the quality of the crop of their suppliers. For the curing barn transition, they were instructed on the decarbonization measures and advised the farms on the process. Further, they educated the farmers on how to improve biodiversity with other crops in the off-season of tobacco. This strengthened the economic stability of the farmers leading to a more resilient supply chain with less risk for PMI.

Many companies in a similar field are acquiring their raw materials in auctions. PMI bets on direct contracts with farmers instead, where they can engage with them. In this way, the company can include conditions that incentivize farmers to produce crop with lower carbon emissions under fair conditions, and cooperate with the farmers to minimize their environmental footprint.

There are some early best practices that are promising to manage the Net-Zero transition:

- Incentivize farmers to decarbonize their production with transition contracts

Example: Draft contracts stating that the company guarantees to buy all of the produced crop at the end of the season. If the crop is produced with lower carbon emissions and better quality accordingly, the company pays a higher price. This incentivizes the farmers to produce low-carbon crop, as they get financially rewarded. - Technical guidance educating the suppliers on implementing low-carbon measures

Example: Identify highest emissions in farmer’s operation and demonstrate low-cost solutions. - Direct contracts fostering a long-term relationship between the supplier and the company

Example: Install multi-year offtake agreements to incentivize the transition, even in the period when yields are lower during the shift from conventional to sustainable farming. - Financial support to enable the decarbonization of the supplier sites

Example: Offer preferential terms to farmers with regenerative practices or project financing through the company. - Paying farmers that sequester carbon

Example: Government finances the transition and remunerates farmers that apply carbon farming. - Collaboration among industry leaders to share best practices and use synergies

Example: Sharing knowledge between industry leaders on how to manage the relationship with the farmers during the transition.

The example of PMI has a relatively low cost for the company and a rapid positive financial outcome. Once these ‘low-hanging fruits’ are picked, higher investments with a smaller impact on the company’s decarbonization will be needed. As long as carbon and oil have a low price as nowadays, it is difficult to make an investment case for some of the needed transitions. Therefore, the governmental regulation of carbon pricing is crucial to reach Net-Zero. After its introduction, financing solutions will gain importance and long-term relationships with the suppliers become even more important in order to receive a payback on such long-term investments. This change in the relationship with suppliers will impact procurement strategies of companies - on one hand, it will build resilience of suppliers leading to lower costs. On the other hand, having a guaranteed market incentivizes the farmers to make changes towards sustainable farming, which should lead to a long-term profitability and reduced physical risk.

#5 Accounting: Preparing for the carbon regulations

The introduction of mandatory carbon pricing represents a major financial risk for businesses that are unprepared. The idea behind it is to hold the polluter accountable for the emissions. It aims at reducing emissions at the source by internalizing the costs of carbon. If unsuccessful, the society pays the costs elsewhere at a much higher price. Introducing carbon pricing therefore ideally shifts investments decisions and behavior across industries.

In developed countries, we are past the point of discussion if a carbon price policy is introduced. The question is, when it will be introduced. In the European Union, there exists a form of carbon pricing with the EU Emissions Trading System since 2005. But the system is too weak: For airline for example, it applies only to inter-European flights, which covers just a fraction of a global airline’s emissions.

It has therefore not generated substantial transformations towards low carbon technologies as expected and is vulnerable to abuse, as companies simply could account for their carbon emissions in a factory outside the EU. Consequently, it is currently undergoing reform and major changes are expected in the coming years. In the United States, carbon pricing regulations are in place in some states. The government is discussing a new nationwide implementation of an appropriate policy. This implies two challenges for global companies:

- Taking responsibility for their emissions without such regulations in place.

- Getting prepared before the governments introduce new policies.

To this end, a company can include a form of ‘True Cost Accounting’ in their processes voluntarily to valuate and internalize the externalities. It raises the awareness about the carbon emitted and how much an effective carbon price would cost the company. The methodologies applied range from shadow pricing, where an internal price is accounted for every ton of produced CO2e, up to a carbon levy, which flows into a climate fund to finance decarbonization projects.

From this derives the next question on how to price externalities. A recent calculation of the IMF revealed the average global carbon price across all systems lays at $2 per ton. At the same time, they informed that globally we need an average price around $75 per ton to reach the Paris Agreement climate goals. Further, a surprising number of companies (60%), which currently face or expect carbon pricing, are not disclosing existing or upcoming carbon regulation as a substantive risk to their investors. This highlights another a potential gap in information for companies and investors to explore. To determine an internal carbon price, companies have to take into account the local context, the policy environment, the social acceptance towards the price and on which Scopes of the value chain to apply it.

Conclusion

Collaboration within the industry is key to find answers for the systemic issues that climate change is posing. It is important not to divide the companies into ‘brown’ and ‘green’, but rather to find ways to learn from greener companies and make brown processes less damaging, as fast as possible.

Many companies have set relevant climate intentions recently, but there lay different challenges in the implementation of financing the transition to Net-Zero emissions. The identified black box is not yet fully disclosed, but by unboxing the 5 areas, this blog sheds some light into the dark, allowing solutions to become more feasible.

Global companies have a major impact and responsibility on climate change. It is time to prove us their intentions and surprise with innovative approaches in the near future. Climate change is not only a cost or burden, but brings opportunities for every company as well.

Sources

- https://www.blackrock.com/corporate/investor-relations/blackrock-client-letter

- https://www.theguardian.com/business/2020/jun/15/unilever-vows-to-invest-1bn-in-green-projects

- https://www.bloomberg.com/news/articles/2020-12-03/nestle-to-invest-3-6-billion-in-fight-against-climate-change

- https://www.climateaction100.org/progress/net-zero-company-benchmark/methodology/

- https://www.climateaction100.org/news/climate-action-100-issues-its-first-ever-net-zero-company-benchmark-of-the-worlds-largest-corporate-emitters/

- https://www.climateaction100.org/progress/net-zero-company-benchmark/

- https://www.bloomberg.com/news/articles/2020-07-16/procter-gamble-s-climate-commitment-leaves-most-emissions-untouched

- https://www.unilever.com/news/news-and-features/Feature-article/2021/why-we-are-putting-our-climate-plans-to-a-shareholder-vote.html

- https://www.cdp.net/en/research/global-reports/global-supply-chain-report-2019

- https://www.statista.com/statistics/588492/greenhouse-gas-emissions-of-pandg-by-type

- https://energypost.eu/10-carbon-capture-methods-compared-costs-scalability-permanence-cleanness/

- https://www.nestle.com/sites/default/files/2020-12/nestle-net-zero-roadmap-en.pdf

- https://www.washingtonpost.com/opinions/2021/03/22/net-zero-pledges-carbon-emissions/

- https://www.reuters.com/article/uk-shell-strategy-carboncapture-carbonof-idUSKBN2AB0TL

- https://www.pmi.com/integrated-report-2019

- https://ec.europa.eu/clima/policies/ets_en

- https://climatepolicyinfohub.eu/eu-emissions-trading-system-introduction

- https://agendi.co/carbon-pricing/

- https://www.ipe.com/news/us-carbon-price-scheme-announced-by-2025-in-new-ipr-for-pri-forecast/10051918.article

- https://www.carbonpricingleadership.org/report-of-the-highlevel-commission-on-carbon-prices

- https://www.ft.com/content/20dd6b82-3dd1-11ea-a01a-bae547046735

- https://www.cdp.net/en/research/global-reports/putting-a-price-on-carbon

- https://www.systemiq.earth/wp-content/uploads/2020/01/RegeneratingEuropessoilsFINAL.pdf

- https://ecdpm.org/great-insights/sustainable-food-systems/minister-martina-italys-experience-green-farming/

ABOUT FRANKLIN UNIVERSITY SWITZERLAND

Franklin University Switzerland is a small, international university located in the southern Swiss city of Lugano. Founded in 1969, Franklin was among the first institutions to bring American Liberal Arts education to Europe, and it is the only liberal arts university in the world accredited in the United States and Switzerland. It is the only university in the world that offers interdisciplinary, experiential learning, placing Academic Travel at the core of its curriculum.

ABOUT UNITAR

The United Nations Institute for Training and Research (UNITAR) is a principal training arm of the United Nations, working in every region of the world. We empower individuals, governments and organizations through knowledge and learning to effectively overcome contemporary global challenges. UNITAR was established in 1965 as an autonomous body within the United Nations with the mandate of enhancing the effectiveness of the work of the United Nations and its Member States. In 2020, UNITAR’s reach extended to more than 300,000 beneficiaries through mostly e-learning and webinars, face-to-face seminars and workshops, or other training-related events. (www.unitar.org).